2025 Tax Updates: Understanding the New Tax Brackets, Social Security Benefits Increase, and More

Table of Contents

- 2025 Social Security Projections: 3 Things to Know [COLA] - YouTube

- Social Security Announces 2.5% COLA for 2025; Benefits Struggle to Keep ...

- Social Security Limit 2025 Earnings Per - Grace Hudson

- Social Security has two surprises in store for retirees starting ...

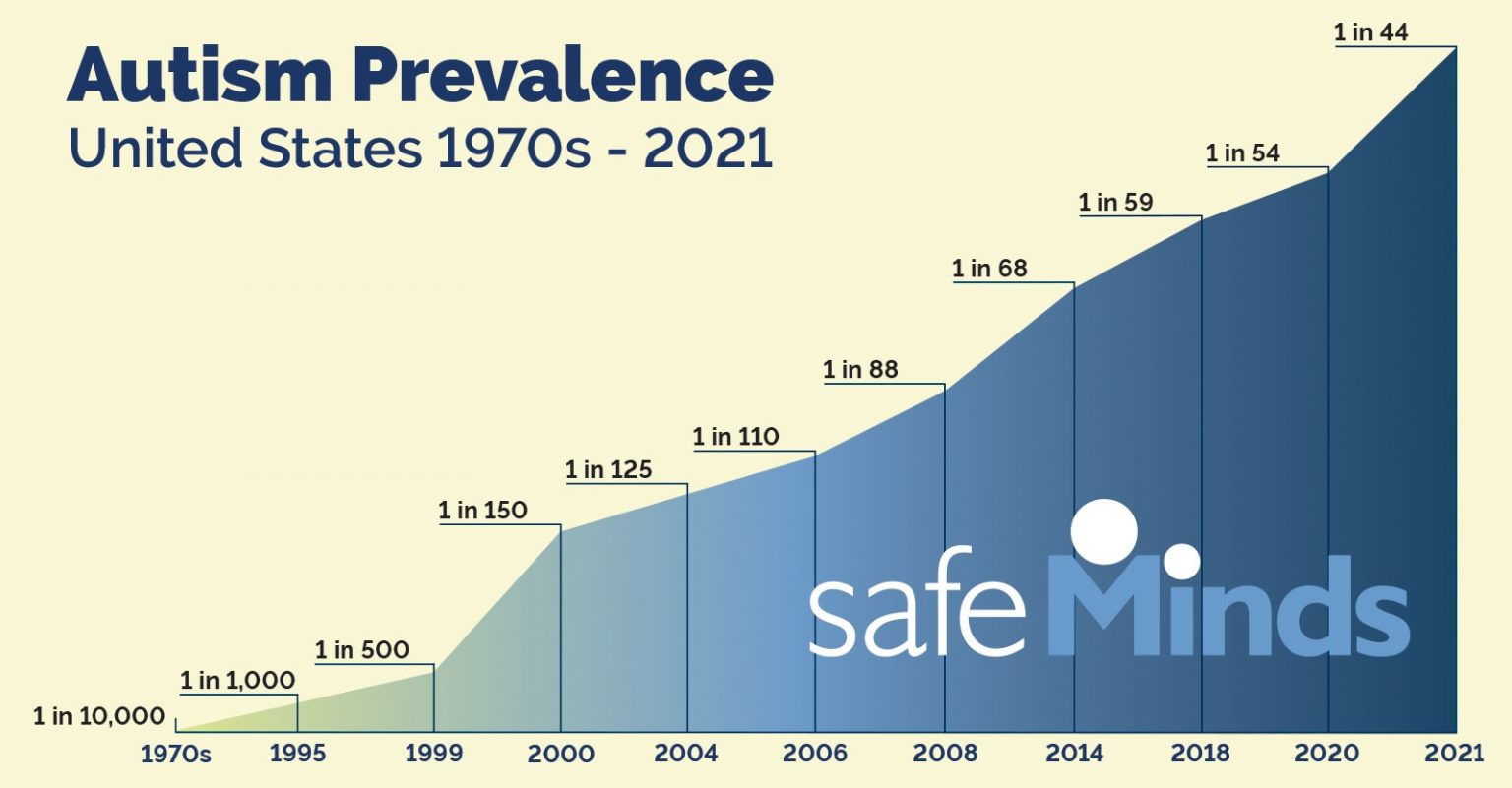

- Supplemental Security Income Increases in 2022 - SafeMinds

- How Big Will The Raise Be For Social Security In 2025?

- 2025 Social Security COLA Estimate - Latest Update - YouTube

- Social security cola increase 2025 Modest Increase Amid Ongoing ...

- Social Security Income Limit 2023 – Social Security Intelligence

- Social Security Claiming Age: Theoretically Optimal vs. Real World ...

![2025 Social Security Projections: 3 Things to Know [COLA] - YouTube](https://i.ytimg.com/vi/l-0Qc1M12c4/maxresdefault.jpg)

2025 Tax Brackets: What You Need to Know

- 10%: $0 to $11,600 (single) and $0 to $23,200 (joint)

- 12%: $11,601 to $47,150 (single) and $23,201 to $94,300 (joint)

- 22%: $47,151 to $100,525 (single) and $94,301 to $201,050 (joint)

- 24%: $100,526 to $191,950 (single) and $201,051 to $383,900 (joint)

- 32%: $191,951 to $243,725 (single) and $383,901 to $487,450 (joint)

- 35%: $243,726 to $609,350 (single) and $487,451 to $731,200 (joint)

- 37%: $609,351 and above (single) and $731,201 and above (joint)

Social Security Benefits Increase: A Boost for Retirees

Other Key Changes for 2025

In addition to the new tax brackets and Social Security benefits increase, there are several other changes you should be aware of:- Standard Deduction Increase: The standard deduction will increase to $13,850 for single filers and $27,700 for joint filers.

- 401(k) Contribution Limits: The contribution limit for 401(k) plans will increase to $22,500, with an additional $7,500 catch-up contribution allowed for those 50 and older.

- Health Savings Account (HSA) Limits: The contribution limit for HSAs will increase to $3,850 for individual coverage and $7,750 for family coverage.

Stay ahead of the curve and plan for a prosperous 2025. Contact us to learn more about how these changes may affect you and to get personalized advice on managing your finances.